In the dynamic landscape of real estate, mortgage rate trends in Mexico play a crucial role in shaping the decisions of potential homebuyers. Understanding these trends and knowing what to watch for can significantly impact the affordability and feasibility of purchasing a property. In this article, we will delve into the mortgage rate trends in Mexico and provide insights on what buyers should pay attention to.

The Impact of Interest Rates on Mortgages

One of the key factors that influence the mortgage rate trends in Mexico is the countrys prevailing interest rates. When the central bank adjusts the benchmark interest rate, it has a ripple effect on mortgage rates offered by financial institutions. Buyers should closely monitor these adjustments as they directly affect the cost of borrowing for a home purchase.

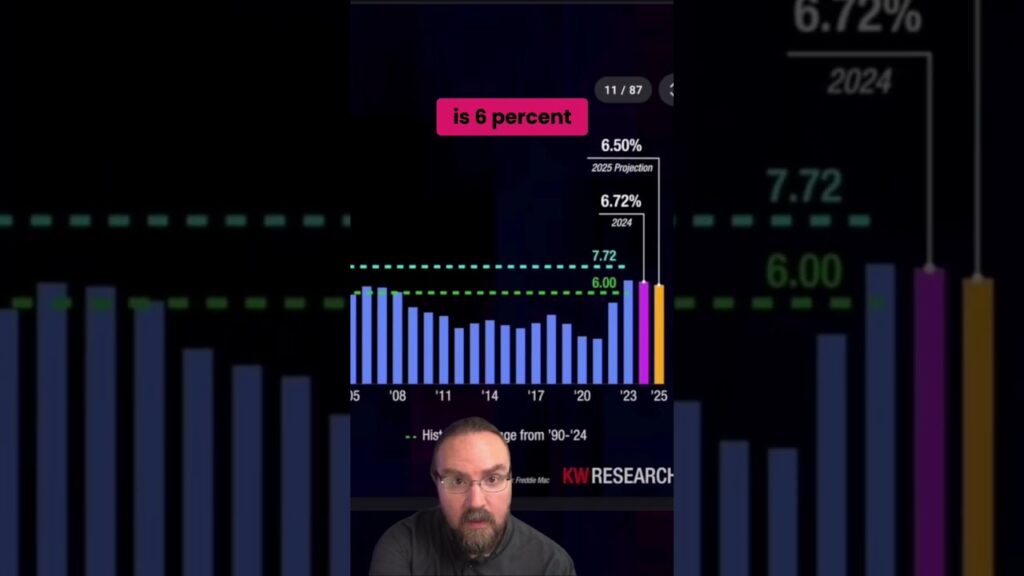

Historical Trends in Mortgage Rates

Looking at historical data can provide valuable insights into the mortgage rate trends in Mexico. By analyzing how rates have fluctuated over time, buyers can make more informed decisions about when to lock in a mortgage. Understanding the patterns and cycles of interest rates can help buyers anticipate potential changes in the future.

Economic Indicators and Mortgage Rates

Various economic indicators, such as inflation rates, GDP growth, and employment figures, can also impact mortgage rate trends in Mexico. A strong economy typically leads to higher interest rates, while a downturn may prompt the central bank to lower rates to stimulate growth. Buyers should stay informed about these indicators to gauge the direction of mortgage rates.

Factors Affecting Mortgage Rates

- Inflation: High inflation rates can erode the purchasing power of money, leading to higher mortgage rates.

- Economic Growth: A robust economy may result in increased demand for loans, pushing mortgage rates up.

- Central Bank Policies: The decisions of the central bank regarding interest rates have a direct impact on mortgage rates.

- Global Economic Conditions: International economic trends can influence local mortgage rates in Mexico.

Forecasting Mortgage Rate Trends

While predicting future mortgage rate trends in Mexico with absolute certainty is challenging, buyers can still benefit from staying informed and consulting with financial experts. By monitoring economic developments, interest rate forecasts, and global market conditions, buyers can gain a better understanding of where mortgage rates may be heading.

Strategies for Buyers in a Changing Rate Environment

Given the potential volatility of mortgage rate trends in Mexico, buyers should consider the following strategies to navigate a changing rate environment:

- Locking in a Rate: When rates are favorable, buyers can opt to lock in a fixed-rate mortgage to secure a stable payment schedule.

- Flexible Financing Options: Exploring different financing options, such as adjustable-rate mortgages, can provide flexibility in a changing rate environment.

- Consulting with Experts: Seeking guidance from mortgage brokers and financial advisors can help buyers make informed decisions based on current market conditions.

Conclusion

As buyers navigate the real estate market in Mexico, staying attuned to mortgage rate trends is essential for making sound financial decisions. By monitoring interest rate fluctuations, understanding economic indicators, and adopting appropriate strategies, buyers can position themselves effectively in a dynamic rate environment. Being proactive and informed about mortgage rate trends in Mexico can empower buyers to secure favorable financing for their dream home.